sarbb.ru

Overview

Volvo Increased Protection

Where can I get my Volvo repaired? Volvo Increased Protection (VIP) coverage is valid and welcome at any authorized Volvo dealer in the US. VIP Tire & Wheel Protection Bundle Plans Take care of damaged tires and wheels caused by road hazards and road surface conditions. Provides unlimited tire and. Total Loss Protection. Volvo Car Financial Services provides customers a plan with extra protection, that may waive up to $1, of your insurance deductible. We offer a number of services through Volvo Increased Protection Plans to help you maintain your Volvo S60 or XC90 in various ways. Volvo has created an optional Wear Protection Plan designed to enhance your first three complimentary maintenance services, helping to provide you with the. Volvo Protection Plan. We offer varied levels of protection that cover everyday risks such as tires, dents, dings, and windshield replacement on either owned or. From in-vehicle technology to mechanical components, to hybrid batteries, your Volvo will be covered for up to 11 years or , miles. SHOP NOW. It's an investment in your way of life, and if you take care of it, it will take care of you. Fortunately, Volvo Increased Protection Plans make it easy to. VIP Stated Component Plan coverage includes towing through OnCall® and rental car reimbursement coverage of $50 per day for up to six days on covered repairs. Where can I get my Volvo repaired? Volvo Increased Protection (VIP) coverage is valid and welcome at any authorized Volvo dealer in the US. VIP Tire & Wheel Protection Bundle Plans Take care of damaged tires and wheels caused by road hazards and road surface conditions. Provides unlimited tire and. Total Loss Protection. Volvo Car Financial Services provides customers a plan with extra protection, that may waive up to $1, of your insurance deductible. We offer a number of services through Volvo Increased Protection Plans to help you maintain your Volvo S60 or XC90 in various ways. Volvo has created an optional Wear Protection Plan designed to enhance your first three complimentary maintenance services, helping to provide you with the. Volvo Protection Plan. We offer varied levels of protection that cover everyday risks such as tires, dents, dings, and windshield replacement on either owned or. From in-vehicle technology to mechanical components, to hybrid batteries, your Volvo will be covered for up to 11 years or , miles. SHOP NOW. It's an investment in your way of life, and if you take care of it, it will take care of you. Fortunately, Volvo Increased Protection Plans make it easy to. VIP Stated Component Plan coverage includes towing through OnCall® and rental car reimbursement coverage of $50 per day for up to six days on covered repairs.

We offer a wide range of protection plans designed to give you added peace of mind. Select from six plans to get the most out of your Volvo experience. Our comprehensive Volvo Increased Protection Plans (VIP) can protect you for years of hassle-free driving. They're all designed to match any driving habit, fit. At Prestige Volvo we offer a wide range of increased protection plans designed to give you added peace of mind. That's why we created our Volvo Protection Plans and Volvo Increased Protection (VIP) Plans to offer added protection from even the most troublesome vehicle. Volvo Increased Protection (VIP) plans are customizable extended limited service contracts that can be configured to suit your needs. Protect your Volvo with the meticulous care and consideration it deserves with Volvo Increased Protection – the only protection products backed by Volvo Cars. Life tends to take what we thought was a normal day and turn it completely upside down. That is the thinking behind the Volvo Increased Protection (VIP). Experience up to 20 percent savings with a pre-paid maintenance plan. It offers protection from inflation, work performed by a certified Volvo dealer with. We offer a wide range of protection plans designed to give you added peace of mind - and help you get the most out of your Volvo experience in New Jersey. Volvo Increased Protection ESC offers extensive coverage, multiple term lengths and different deductible options for New, Used, and Certified by Volvo vehicles. protection. Certain restrictions, limitations and/or exclusions may apply IMPROVED RESALE. Each plan is fully transferable to a subsequent owner. Extended Vehicle Service Contracts. From in-vehicle technology to mechanical components, to hybrid batteries, your Volvo will be covered for up to 11 years or. Depending on the age and mileage of your vehicle, you can extend your protection for up to seven additional years or up to , miles, whichever comes first. Life tends to take what we thought was a normal day and turn it completely upside down. That is the thinking behind the Volvo Increased Protection (VIP). Offers protection against common risks that can occur during every day driving. Provides 4 levels of protection that can be customized to your needs: Tire &. We at McDonald Volvo Cars are proud to assist our customers in finding the right protection for them. Please contact us at any point to learn more. We offer a wide range of protection plans designed to give you added peace of mind. Select from six plans to get the most out of your Volvo experience. Our comprehensive Volvo Increased Protection Plans (VIP) can protect you for years of hassle-free driving. They're all designed to match any driving habit, fit. Volvo offers two extended warranty options for owners who want longer repair coverage through the Volvo Increased Protection (VIP) plan. What does the Volvo. Volvo Increased Protection. Extra protection designed specifically for your Volvo. · Extended Service Contract · Prepaid Maintenance · Excess Wear & Tear.

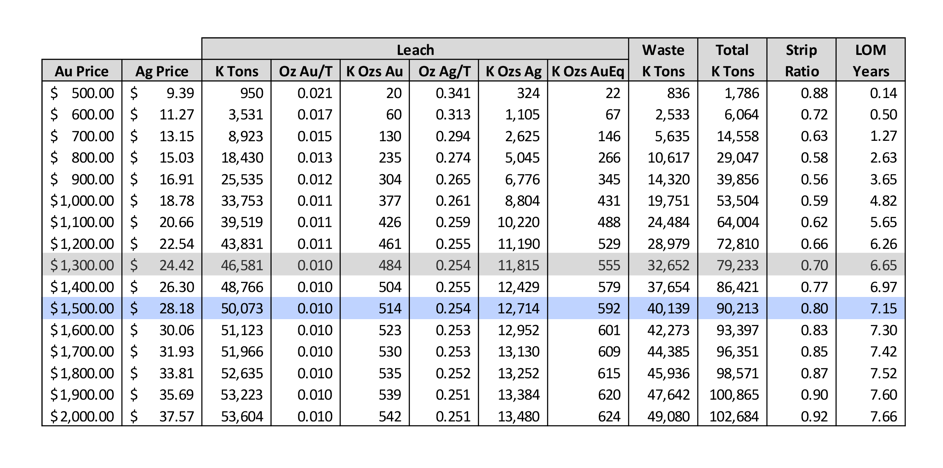

Bravada Gold Stock

Bravada Gold Cancels Previously Announced Financing; Announces New Non-Brokered Private Placement; Drilling Planned at Highland Project & Exploration. As of today, Bravada Gold Corporation market cap is M. What is Bravada Gold Corporation Earnings Per Share? The Bravada Gold Corporation EPS is. BGAVF | Complete Bravada Gold Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Bravada Gold is number one stock in market capitalization category among related companies. Market capitalization of Materials industry is currently estimated. Investors. Stock Information · Corporate Presentation · ESTMA - Extractive Sector Transparency Measures Act · Financial Reports · Fact Sheet · Media · Project. Company profile, investor kit, stock price and press releases for Bravada Gold (TSXV:BVA). Key facts to help you invest in one of the top Gold stocks. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume39, · Dividend- · Dividend Yield- · Beta- · YTD % Change Bravada Gold Corporation ; Prev. Close. ; Low. ; 52wk Low. ; Market Cap. m ; Total Shares. m. Bravada Gold Corp ; Previous Close: ; Volume: ; 3 Month Average Trading Volume: ; Shares Out (Mil): ; Market Cap: Bravada Gold Cancels Previously Announced Financing; Announces New Non-Brokered Private Placement; Drilling Planned at Highland Project & Exploration. As of today, Bravada Gold Corporation market cap is M. What is Bravada Gold Corporation Earnings Per Share? The Bravada Gold Corporation EPS is. BGAVF | Complete Bravada Gold Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Bravada Gold is number one stock in market capitalization category among related companies. Market capitalization of Materials industry is currently estimated. Investors. Stock Information · Corporate Presentation · ESTMA - Extractive Sector Transparency Measures Act · Financial Reports · Fact Sheet · Media · Project. Company profile, investor kit, stock price and press releases for Bravada Gold (TSXV:BVA). Key facts to help you invest in one of the top Gold stocks. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume39, · Dividend- · Dividend Yield- · Beta- · YTD % Change Bravada Gold Corporation ; Prev. Close. ; Low. ; 52wk Low. ; Market Cap. m ; Total Shares. m. Bravada Gold Corp ; Previous Close: ; Volume: ; 3 Month Average Trading Volume: ; Shares Out (Mil): ; Market Cap:

Stock Information · TSX-V: BVA · OTCQB: BGAVF. Zoom, View 1 month, View 3 months.

As of today, Bravada Gold Corporation market cap is M. What is Bravada Gold Corporation Earnings Per Share? The Bravada Gold Corporation EPS is. How to buy Bravada Gold stock online? You can buy Bravada Gold shares by opening an account at a top tier brokerage firm, such as TD Ameritrade or tastyworks. Bravada Gold Corporation ; Prev. Close. ; Low. ; 52wk Low. ; Market Cap. m ; Total Shares. m. Bravada Gold Corp ; Previous Close: ; Volume: ; 3 Month Average Trading Volume: ; Shares Out (Mil): ; Market Cap: Bravada Gold Corp is an exploration-stage company. The firm engages in the acquisition and exploration of natural mineral resource properties. Total of 34,, share purchase warrants, all of which are exercisable at $ per share (collectively, the "Warrants" Appreciation -. Bravada Gold Corporation (BRTN) · Volume: 0 · Bid/Ask: / · Day's Range: - Bravada Gold Corp. engages in the acquisition, exploration, and development of natural resource properties. Its projects include Wind Mountain, Highland, SF /. Bravada Gold Corporation ; EPS ; P/E ; · Cap ; Nov 22Next Earn. Bravada Gold Corp is an exploration-stage company. The firm engages in the acquisition and exploration of natural mineral resource properties. In depth view into BVA.V (Bravada Gold) stock including the latest price, news, dividend history, earnings information and financials. Bravada Gold Corp. ; Volume, K ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), N/A. Bravada Gold Corp. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Is Bravada Gold Corporation stock A Buy? Bravada Gold Corporation holds several negative signals and is within a very wide and falling trend, so we believe it. Bravada Gold (BGAVF) announces the extension of 34,, share purchase warrants at $ per share until April 28, , due to challenging market conditions. Bravada Gold Corporation operates as an exploration and development company. The Company explores for gold. Bravada Gold serves customers in the United States. Altiplano Metals Inc. $ APN % ; Miss Grand International PCL. ฿ MGI % ; Banyan Gold Corp. $ BYN % ; Thunderstruck Resources Ltd. If you are looking for stocks with good return, Bravada Gold Corporation stock can be a bad, high-risk 1-year investment option. Bravada Gold Corporation real. Over the last year, Bravada Gold shares have traded in a share price range of $ to $ Bravada Gold currently has ,, shares outstanding. The. Bravada Gold Corporation is a Canada-based exploration and development company. The Company is engaged in exploring precious metals in gold trends in gold.

Can I Call A Number I Blocked

A blocked call is a call made to a number, but the call does not connect because the recipient has programmed the phone to decline or block the caller's number. Solved: I am trying to call an insurance company in England to make a claim. I have paid for the "add on" to do this, and I'm using the. For Android, go to Settings > Call Settings > Additional Settings > Caller ID. Then, select Hide Number. Your calls will remain anonymous and you can bypass. When you block a number on your Android™ phone, you no longer get calls or texts from it. Maybe you blocked someone you used to date and want to avoid. If you're using Robokiller, you might be curious about what happens when a blocked number attempts to call you. Here's the breakdown. Blocked chats will not be able to call you or send you messages through Signal. Block Unblock Steps to view which chats have been. Call a Landline. Land-based home phones do not allow the number block. If you have the person's home phone, just call him/her directly. When you block someone on your Android phone, the person can't reach you via calls or messages. When the blocked number calls you, the person hears a pre-. One of the best ways to block unwanted calls on a cell phone is to download a call-blocking app, which acts like a filter. The company behind the app uses call. A blocked call is a call made to a number, but the call does not connect because the recipient has programmed the phone to decline or block the caller's number. Solved: I am trying to call an insurance company in England to make a claim. I have paid for the "add on" to do this, and I'm using the. For Android, go to Settings > Call Settings > Additional Settings > Caller ID. Then, select Hide Number. Your calls will remain anonymous and you can bypass. When you block a number on your Android™ phone, you no longer get calls or texts from it. Maybe you blocked someone you used to date and want to avoid. If you're using Robokiller, you might be curious about what happens when a blocked number attempts to call you. Here's the breakdown. Blocked chats will not be able to call you or send you messages through Signal. Block Unblock Steps to view which chats have been. Call a Landline. Land-based home phones do not allow the number block. If you have the person's home phone, just call him/her directly. When you block someone on your Android phone, the person can't reach you via calls or messages. When the blocked number calls you, the person hears a pre-. One of the best ways to block unwanted calls on a cell phone is to download a call-blocking app, which acts like a filter. The company behind the app uses call.

Fortunately, both the local law enforcement and your phone provider should be able to help you find the number behind the blocked calls you have been receiving. Scroll down and tap Block this Caller. Confirm, and calls from that number will go straight to voicemail. Blocking a caller from your Recent calls list on. *If you send a message to a blocked number on your desktop, you'll be prompted to unblock the number before the message can be delivered. Unblock someone saved. As mentioned in my previous post, blocking or rejecting calls on your phone only prevent the calls from ringing your phone. It does not block the calls on the. Using *67 to hide your caller ID will not bypass this block. The recipient will still be able to block your call, even if your number is hidden. Creating a block list and using a Function that compares the incoming number to its contents will allow you to decide whether to Reject an incoming call, or. You can retrieve phone numbers of callers you have blocked on your iOS or Android device using the default software installed on the phone. Land-based home phones do not allow the number block. If you have the person's home phone, just call him/her directly. Call a Landline. Use Another Phone. If. To remove Blocked numbers from the telephones Blocked number list you need to access the programming menu for Call Block. The programming steps vary by model. But Scam ID and Scam Block technologies identify and help stop them before you ever get the call. Specific callers can also be blocked. There are a number of. Dial * This code will block your number so that your call shows up as an "Unknown" or "Private" number. Open the Phone app. · Tap More options (three vertical dots), then Settings. · Go to Block numbers, enter the phone number, and tap the Add icon. · You can also. How do I block Caller ID for a specific call? · Enter * · Enter the number you wish to call (including area code). · Tap Call. The words "Private," "Anonymous,". Method 2: Contacting Through a Different Phone Number: · Ask a friend or family member if you can use their phone or borrow their SIM card temporarily to make. Account owners and admins can manage blocked numbers in the account. Blocked numbers can be incoming (numbers will be blocked from calling in and sending SMS). A blocked call is a call made to a number, but the call does not connect because the recipient has programmed the phone to decline or block the caller's number. I have a couple of family members in my contacts whose calls never reach my phone. I will always find a notification saying "Call Blocked" and then the number. Use a temporary phone number and get a 7-day free phone number trial, now with unlimited calling and texting! Sign-up today! Open the Phone app. · Tap More options (three vertical dots), then Settings. · Go to Block numbers, enter the phone number, and tap the Add icon. · You can also. What is call blocking? How does it work? You can block calls by compiling or subscribing to lists of phone numbers that you would prefer didn't reach you.

501 Retirement Plan

We're committed to help you reach your retirement goals. No matter where you are in your journey, Horace Mann will be with you every step of the way. Retirement Plan Limits: IRS limits for voluntary contributions to (b) and (b) are $23, for Employees 50 or over may contribute an. These plans are similar to (k) plans but are specifically designed for employees of public schools, non-profit organizations, and certain ministers. under Section (c) (3) of the code, or by employees of public educa- tional systems. Tax-sheltered annu- ities are similar to (k) plans in many. Employer-based retirement plan that promises retirees a certain benefit upon retirement, regardless of investment performance. Section of the Internal. if the contributions or benefits provided under the plan do not discriminate in favor of highly compensated employees (within the meaning of section (q)). Local is proud of its affiliation with the IUOE Central Pension Fund (CPF). Established in , the CPF is the third largest multiemployer defined benefit. Keep your plans running smoothly with the (b) Plans - A Guide for (c)(3) Organizations (PDF) Know the contribution rules for your plan: Contributions. Organizations de- scribed in section (c)(18) are trusts created before June 25, , forming part of a plan for the payment of bene- fits under a pension. We're committed to help you reach your retirement goals. No matter where you are in your journey, Horace Mann will be with you every step of the way. Retirement Plan Limits: IRS limits for voluntary contributions to (b) and (b) are $23, for Employees 50 or over may contribute an. These plans are similar to (k) plans but are specifically designed for employees of public schools, non-profit organizations, and certain ministers. under Section (c) (3) of the code, or by employees of public educa- tional systems. Tax-sheltered annu- ities are similar to (k) plans in many. Employer-based retirement plan that promises retirees a certain benefit upon retirement, regardless of investment performance. Section of the Internal. if the contributions or benefits provided under the plan do not discriminate in favor of highly compensated employees (within the meaning of section (q)). Local is proud of its affiliation with the IUOE Central Pension Fund (CPF). Established in , the CPF is the third largest multiemployer defined benefit. Keep your plans running smoothly with the (b) Plans - A Guide for (c)(3) Organizations (PDF) Know the contribution rules for your plan: Contributions. Organizations de- scribed in section (c)(18) are trusts created before June 25, , forming part of a plan for the payment of bene- fits under a pension.

(b) plan. Reserved for schools, churches, charities, and other entities exempt under IRC code (c)(3); tax-deferred retirement plan that allows. Nonprofit organizations typically use (b) plans, (k) plans, SIMPLE IRA plans, and other retirement plans for employees. To explain this as simply as possible, a "Defined Contribution Plan" is a type of "Qualified Retirement Plan," which means it is designed to offer tax. The (c) employer is required to own the asset until the employee leaves employment, at which time an election must be selected for the manner of. The "Retirement plan" indicator in Box 13 shows whether an employee is an active participant in your company's plan. Furthermore, all benefits under a cash balance plan (including benefits accrued prior to a conversion) must be fully vested after 3 years of service. What. The "(k)" Plan: Fund Your Retirement - Palm Beach Research Group ; Item Number. ; Book Title. The "(k) Plan ; Signed. No ; Accurate description. (c)(18) is an Internal Revenue Service (IRS) tax exemption status that applies to a special class of employee pension trusts created before June 25, (3) Plans under section (c)(18)Notwithstanding paragraph (1), the amount allowable as a deduction under subsection (a) with respect to any contributions. (ii) subsidized early retirement benefits and joint and survivor annuities shall not be treated as being unavailable to employees on the same terms merely. A (c)(3) organization is a nonprofit organization and can sponsor either a (k) plan or a (b) plan. A (k) is a tax-advantaged retirement savings plan. Named after a section of the US Internal Revenue Code, the (k) is an employer-provided, defined-. (k) - A defined contribution plan that permits employees to have a portion of their salary deducted and contributed to a retirement account. Contributions to a (c) plan guarantee a pension when you retire. According to the IRS, "organizations must be organized and operated exclusively for exempt. Operating Engineers Local Individual Account Plan and Security Trust Fund · Need To Call Us? - Benefit Office at () A (b) is a retirement plan offered by public schools and certain (c)(3) organizations. Not subject to ERISA, a (b) provides greater flexibility and. Simply stated, (b)(9) plans are for churches, or those with (c)(3) church status, while (b) and b(7) plans are for everyone else. There is no reason. The Plan is funded by employer contributions, which are held in trust pursuant to a Trust Agreement between the International Union of Operating Engineers and. Simply stated, (b)(9) plans are for churches, or those with (c)(3) church status, while (b) and b(7) plans are for everyone else. There is no reason. Delivering secure retirement benefits and exceptional service to our members. contact. () () ; W. Capitol, Suite Little.

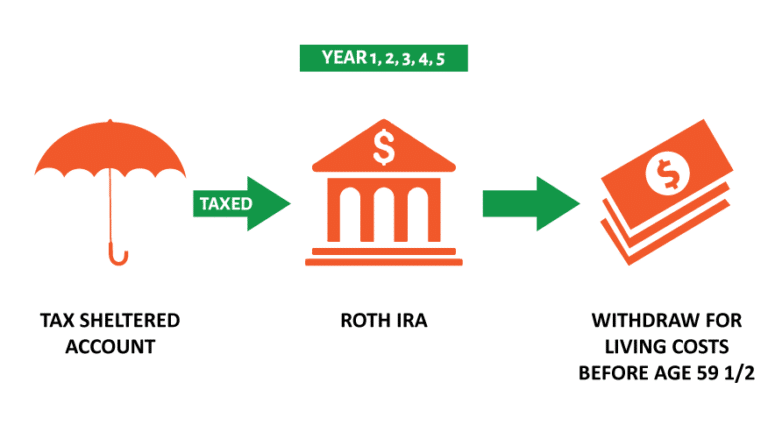

How Do I Convert A 401k To A Roth Ira

How to Convert to a Roth (k) · Check with your employer or plan administrator to see if converting is even an option. · Calculate the tax of converting. · Set. Lastly, if you plan to contribute to any charities, or leave any assets to charity at the end of your life, fully converting your k and IRA to Roth IRAs may. You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. Any additional contributions and earnings can grow tax-free. You are not. Submit a NYCE IRA Incoming Rollover Form. If the assets are from the City's Roth (k) Plan, they can be rolled over after severance from City service (or. You can do what's called a Roth conversion—moving money from a pre-tax account to a Roth IRA and paying taxes on it at the time of conversion. This might be. If you believe you will be in a higher tax bracket during retirement than you are now, a conversion will likely save you money. For example, if you're in the A Roth conversion occurs when funds are distributed from a traditional IRA or (k) retirement account into a Roth IRA account. A rollover is when you move money from an employer-sponsored plan, such as a (k) or (b) account, into an employer-sponsored plan held at Vanguard or a. A conversion must be completed by December 31 to be included in that year's taxable income. Managing the tax impact of a Roth IRA conversion requires careful. How to Convert to a Roth (k) · Check with your employer or plan administrator to see if converting is even an option. · Calculate the tax of converting. · Set. Lastly, if you plan to contribute to any charities, or leave any assets to charity at the end of your life, fully converting your k and IRA to Roth IRAs may. You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. Any additional contributions and earnings can grow tax-free. You are not. Submit a NYCE IRA Incoming Rollover Form. If the assets are from the City's Roth (k) Plan, they can be rolled over after severance from City service (or. You can do what's called a Roth conversion—moving money from a pre-tax account to a Roth IRA and paying taxes on it at the time of conversion. This might be. If you believe you will be in a higher tax bracket during retirement than you are now, a conversion will likely save you money. For example, if you're in the A Roth conversion occurs when funds are distributed from a traditional IRA or (k) retirement account into a Roth IRA account. A rollover is when you move money from an employer-sponsored plan, such as a (k) or (b) account, into an employer-sponsored plan held at Vanguard or a. A conversion must be completed by December 31 to be included in that year's taxable income. Managing the tax impact of a Roth IRA conversion requires careful.

If you're retiring and have appreciated company stock in your traditional (k) or other qualified workplace savings plan, it may not make sense to convert. If you have a Roth option within your retirement plan, you may be able to convert the after-tax (k) amounts to a Roth (k). This is called an in-plan Roth. Unlike Roth IRA rollovers, Roth in-plan conversions cannot be revoked [ ] Terminated or over age 59½: To convert balances into a Roth after-tax. 1. If you believe you will be in a higher tax bracket during retirement than you are now, a conversion will likely save you money. For example, if you're in the First, you start by deciding how much of your traditional IRA you want to convert to a Roth IRA. You can convert the entire amount in your account, but you're. As long as taxes are paid on the conversion (i.e., pre-tax) amount, anyone can convert a traditional IRA, or other eligible retirement plan asset,Footnote 1 to. If your employer offers a separate account for after-tax contributions, you can roll that money into a Roth IRA without emptying your (k) plan. Sticking with. Yes, you can have a Roth IRA and a (k) if you're eligible for your employer's (k) plan and you qualify to contribute to a Roth IRA. But, since Roth is "after tax dollars" the advantage is it grows tax free, provided that you follow the rules. So convert as much of your. Yes, the deadline is December 31 of the current year. A conversion of after-tax amounts is not included in gross income. Any before-tax portion converted will. If you have a traditional (k) or (b), you can roll over your money into a Roth IRA. However, this would be considered a "Roth conversion," so you. Yes, it could make sense to open a Roth IRA at least five years before you plan to rollover your Roth (k). However, it's not enough to open it. For instance, if you expect your income level to be lower in a particular year but increase again in later years, you can initiate a Roth conversion to. But, since Roth is "after tax dollars" the advantage is it grows tax free, provided that you follow the rules. So convert as much of your. Rolling over a (k) to a Roth IRA involves converting pre-tax retirement savings to an account funded with after-tax dollars. Roth IRA. Traditional. IRA. SIMPLE IRA. SEP-IRA. Governmental. (b). Qualified plans include, for example, profit-sharing, (k), money purchase, and. How to move your old (k) into a rollover IRA · Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into your. You can do what's called a Roth conversion—moving money from a pre-tax account to a Roth IRA and paying taxes on it at the time of conversion. This might be a. If you have money in a designated Roth (k), you can roll it directly into a Roth IRA without incurring any tax penalties. However, if the (k) funds are. How to move your old (k) into a rollover IRA · Step 1: Set up your new account · Step 2: Contact your old (k) provider · Step 3: Deposit your money into your.